As Featured in

Budge Huskey:

I mean, let’s face it, we know that the Florida market as a whole, but particularly Southwest Florida, accelerated too rapidly during the pandemic surge. And both sales and prices really went beyond anything that would normally be supported by fundamentals of real estate.

Ed Jahn:

People focus on the price people pay for residents, so the recent sales transactions of $84, $85 million or over $100 million for residences. Those are news making articles and stories, and Naples is an area that has homes, has locations that offer that.

Budge Huskey:

I’m Budge Husky. I’m the Chief Executive Officer of Premier Sotheby’s International Realty, our home office is based in Naples, Florida.

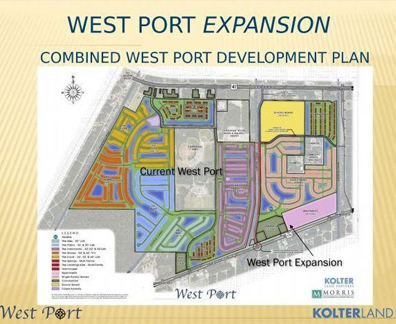

Ed Jahn:

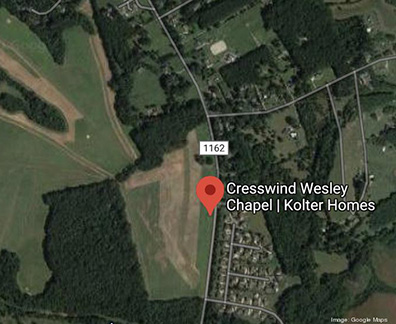

I’m the Senior Vice President here at Kolter Urban. We’re a large real estate development company.

Budge Huskey:

Southwest Florida, as most people know, was one of the areas during the pandemic, which accelerated at an phenomenal pace. And this was true of all of Southwest Florida from Naples, Gulf, Cape Coral, Fort Myers, everywhere. And during that period of time of approximately two years. But if you even go back a couple before that, what you found is that housing values increase by approximately 75%. That’s true in Cape Coral. So what happened is when there was so much demand pulled forward, and then the combination of hurricanes and just the natural relapse as far as buyer demand, what happened is that pullback caused a reduction in overall prices in the market. So that occurred in Cape Coral as an example. Prices declined by 10% year over year, which is a pretty significant amount. But if you look at the big picture, what you realize, it’s only those individuals who would’ve purchased real estate in the last couple of years, that if they sold today, they would be underwater in terms of their mortgages. The vast majority of people in the market either don’t have a mortgage, or if they purchased before 2000, let’s say 2020, they would absolutely have probably about a 65% gain. And I’m not sure how many other markets across the country could say that.

Ed Jahn:

A lot of times in different markets, that are markets that are fringe markets, they can fluctuate up and down with the changes in the market, and you can experience things like that where people can get upside down because home values will fluctuate a little more. In the Naples area, you’re not seeing that up and down. Fluid fluctuation in the pricing. You’ll see some ups and downs that’s typical depending on the market, but they’re very constant. The values are very constant. That’s one thing about the Naples area.

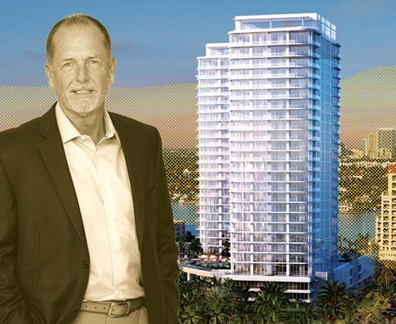

Budge Huskey:

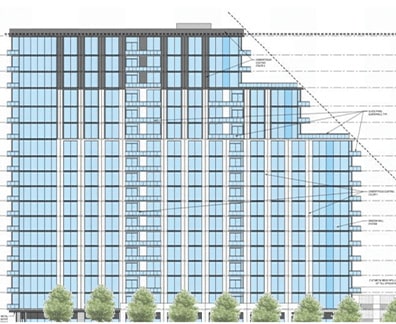

It’s reflective of a trend that has occurred over the last few years and the level of additional wealth and attention and investment that has occurred in the Naples market. It’s just a matter of the evolution with older product being torn down on the waterfront and in its place has really now become significant luxury projects. There are condominiums, and this particular case, luxury condominiums that start in the $30 million range. There are some that have sold as high as $70 million, and we have single family properties that have sold for over $200 million in the market. So Naples has kind of found its place on the national and international stage as a true destination for wealth.

![[Renderings] Kolter Urban Breaks Ground on Graydon Buckhead Condos Thumbnail](/wp-content/uploads/2020/04/graydonbuckheadrenderingwhatnowatl-min-396x324-1.png)