As Featured in South Florida Business Journal

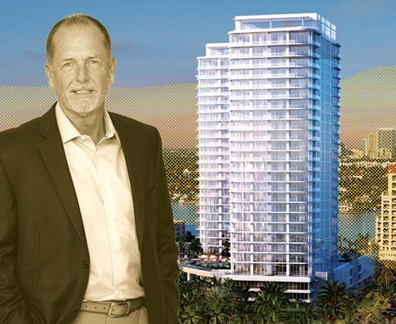

Kolter Group, Carlyle Group and Altman acquired a development site in the Biscayne Shores neighborhood of Miami-Dade County for $15 million and landed a big construction loan.

Bianca Investments LLC, managed by Alejandro Silberman in Miami, sold the 3.26-acre site at 11240 Biscayne Blvd. to CRP/KMF Alton Biscayne Owner, part of Delray Beach-based Kolter Group, Washington, D.C.-based Carlyle Group, and Fort Lauderdale-based Altman. PNC Bank provided a $86.1 million construction loan to the buyers. Property data firm Vizzda confirmed the parties in the deal. Julian Zuniga and Gerard Yetming of Colliers brokered the deal.

The vacant land last sold for $2.87 million in 2012, so it had a big gain in value after development plans were approved.

In 2023, Altman Cos., a subsidiary of Fort Lauderdale-based BBX Capital Corp., filed development plans for the site. Those plans were amended in 2024. It turns out that Altman brought in both Kolter and Carlyle as partners in the project. Altman said the Alton Biscayne apartments should be completed in 2027.

“We’re proud to team up with Altman on Alton Biscayne, a project that reflects our shared vision for creating a high-quality, amenity-rich community,” said Jeff Quinlivan, president of Kolter Multifamily. “This collaboration brings together two experienced development teams to deliver a thoughtfully designed residential experience in one of Miami’s most dynamic corridors.”

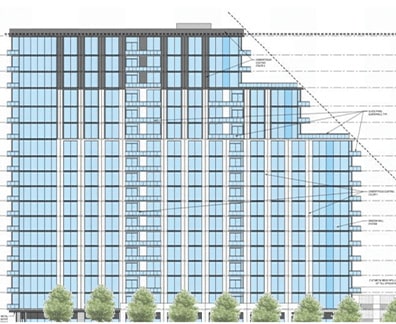

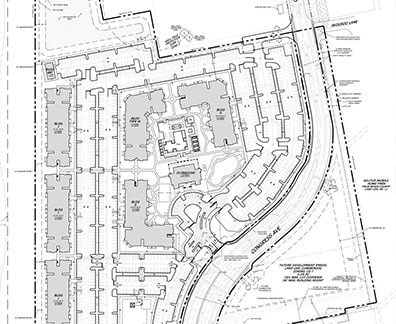

According to Vizzda and verified in county records, the 12-story project was approved for 336 apartments, including 71 workforce housing units, and 527 parking spaces. The amenities on the eighth floor would include a pool, a 1,700-square-foot health club and a 2,700-square-foot clubhouse. There would be an additional 4,600 square feet of amenity space on the ground floor facing Biscayne Boulevard.

“Through the combined experience and proven track records of our teams, we look forward to introducing a community that offers North Miami residents an exceptional living experience,” said Seth Wise, CEO of Altman.

![[Renderings] Kolter Urban Breaks Ground on Graydon Buckhead Condos Thumbnail](/wp-content/uploads/2020/04/graydonbuckheadrenderingwhatnowatl-min-396x324-1.png)